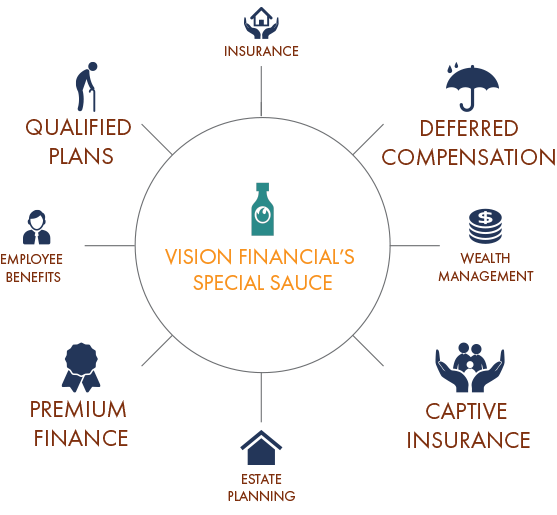

Qualified Plan

Many companies are underutilizing their ability to not only contribute to, but design the right type of corporate sponsored retirement plan. When people think of a company retirement plans most think of 401k. Although this is a good employee plan, it really discriminates toward the highly compensated or business owner. Our approach is to create an efficient and effective plan. Where contributions for the highly compensated or business owners are in the hundreds of thousands if desired. Let us show you how, through a few tweaks, you can design a plan that allows for great tax savings on the contributions and a majority of those contributions go to benefit the business owner and/or key employees.

Deferred Compensation Plans

One very popular notion in today’s retirement and tax planning discussion, is diversification. There are many ways to describe them, but deferred compensation plans allow a client great diversification. Similar to a qualified plan, deferred compensation plans are corporate sponsored. They allow the corporation to contribute dollars that are tax deductible (partially taxable to participant), they grow tax deferred and are distributed tax free at retirement. With no mandated retirement age, these plans allow for flexibility for when you want to start taking income.

Captive Insurance Company

Utilizing a Micro Captive accomplishes a variety of clients planning needs. Frist, it’s a way to shift risk from an operating company to a commonly owned insurance entity. This allows a client to better manage their risk leading to increase surplus or retained earnings on their premium dollars. There are creditor protection features and yes, there are even tax benefits. This is not a strategy that fits for everyone, but with a properly designed CIC, clients are able benefit from risk management, retained earnings and tax deductions for premiums paid.

Wealth Management

In the world of investment management, there are many aspects that have become commoditized. One broker or manager says they have they latest and greatest strategy, only to be outdone by another promoter the next month. Clients don’t want to feel as if they only have option A or B. That’s what makes our approach so different. We believe in listening to the client and finding a customized solution that fits their philosophy. Many business owners view their business as their risk and would like to have the money they set aside treated a bit different. Let us show you that difference.

Premium Finance

Many business owners and successful people understand the need for insurance. Whether it be to provide income upon death, estate liquidity or supplemental income at retirement; there can be tremendous value. Premium finance is a way to let the “bank”, so to speak, pay for the premium. Now this may not fit for everyone, but for those that could benefit from this solution, it could make a lot of sense.

Tax Diversification

You certainly have heard of investment diversification, which is prudent, we believe in tax diversification. In other words, why put all of your assets (eggs) in one tax basket? Through proper planning and the usefulness of the IRS tax code, we strongly believe in optimizing your tax scenario today as well as in the future. We diversify in investments to mitigate the market volatility. Regarding taxes, we diversify to reduce the risk of tax volatility. Are taxes going to go up or down in the future? You don’t necessarily need to guess correctly to that questions if you have tax diversification working for you. Ask us how?